By Ky Lee Man

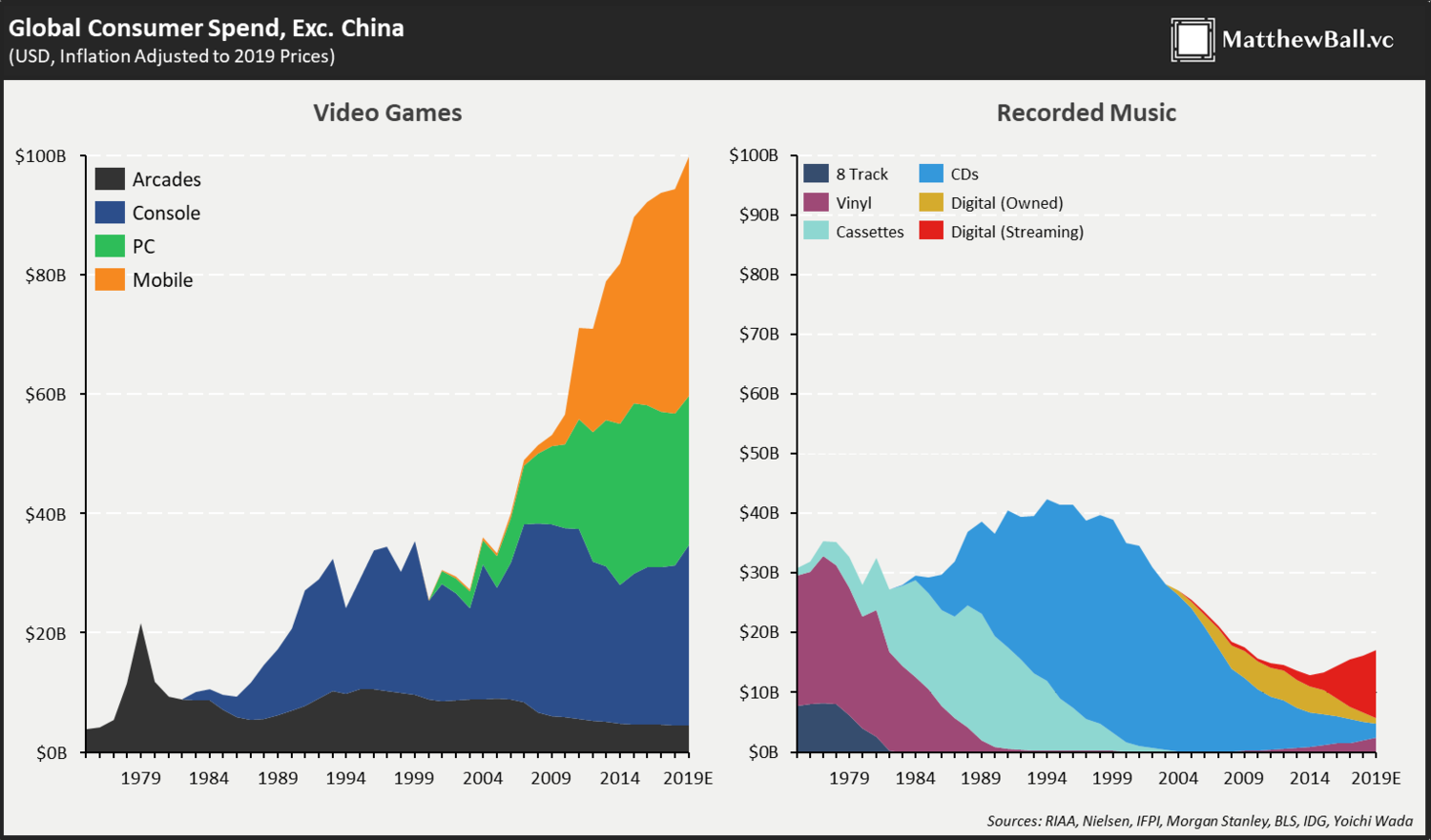

Gaming is considered to be the next frontier in media for its interactivity, immersivity, personalization, and ability to be a social square/space without the need to be physically present. Numerically, gaming revenue is now $120 billion dollars per year compared to the $30 billion and $42.5 billion dollar music and movie industry, respectively.

With an increase interest in gaming, gaming IP should become more popular and can be used to create content through various mediums. Matthew Ball goes into depth on how gaming IP is experiencing modest, but greater success at the box office than in the past, and the soon to be content explosion of gaming IP adapted to TV and films in the next few years.

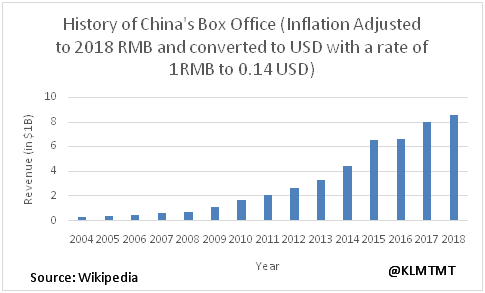

China has seen an increase in revenue going towards the movie, and gaming industry. China's box office has been the second largest since 2012, and has seen an increase YoY, with a 2018 high of $8.5B.

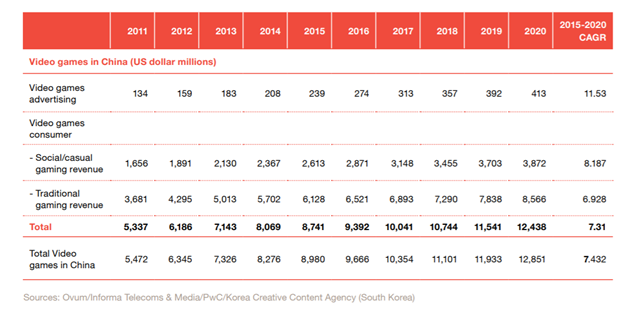

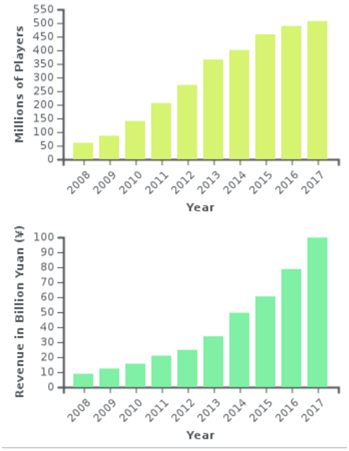

China's gaming market has also grown YoY (although the data on this is quite varied, but nonetheless, growth is consistent throughout the different methodologies).

PWC:

Wikipedia: which is from http://www.cgigc.com.cn/member/upload/pms/201708/03180814msz5.pdf.

The number of players have increased 10 fold in the span of 10 years. The second chart below shows that gaming revenue has grown from $1.246B in 2008 to $13.97B in 2017 (assuming a conversion rate of 1RMB to $0.14). China's 2019 gaming population of 630MM shows the demand for gaming is still growing and likely has more appetite.

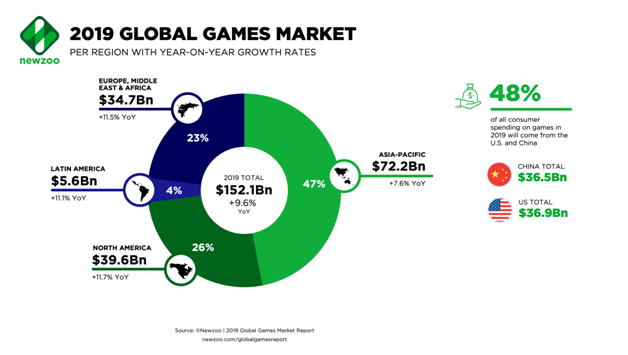

As of 2019 consumer spend on gaming in China is on par with the U.S.

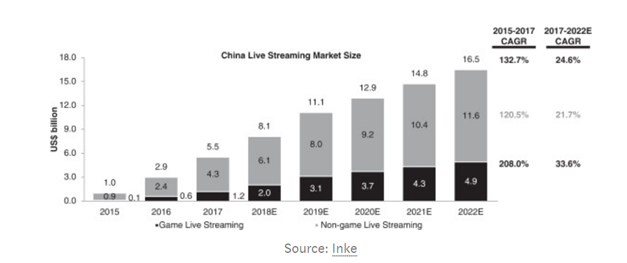

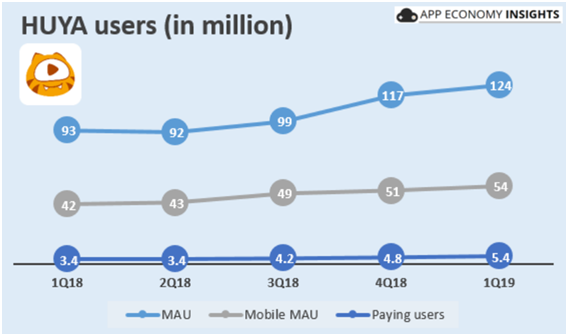

Furthermore, game viewing (and its market) on Chinese streaming sites has been rising as well. The expected 2022 $5B gaming live streaming market shows there is demand for and awareness of game IP. Huya has seen a steady increase in users from Q1 2018 to Q1 2019. Mobile live streaming MAUs is also on the rise for other streaming (and live-streaming) Chinese companies focused on the population of China. The Huya-Douyu duoply (the top two gaming live-streaming companies) have reached 146.1M and 163.6MM MAUs, respectively, in Q3 of 2019 which is larger than Twitch's MAU of 140M in February 2020. The increase in game streaming builds marginal affinity of gamers towards gaming IP, which in turn should help an expanded ecosystem of said IP, whether that is the game itself, or any other media content containing the game IP.

With the increase in popularity of gaming, and the box office does gaming IP go hand-in-hand with a box office smash?

Note: I can barely read Chinese, and there is very limited publicly available English language literature and data on China's media industry. I am writing this essay based on information I know and can research to the best of my knowledge. I may be not completely accurate with certain claims, so if you find an inaccuracy feel free to inform me, and I will be more than happy to update this essay.

Gaming IP in Movies

Live action:

The first and only live action movie based on IP (that I know of) is Legend of the Ancient Sword, released in 2018. It garnered a total gross of $2,029,441, with an opening day sum of $1.25MM, and an average ticket price of $5 (movies in China are considerably cheaper than in the U.S.!), with screens only in China. In 2018, Chinese language films in China took in $5.53B (note in the graph above, it says 2018 recorded $8.5B in China's box office, but that also includes non-Chinese language films), from 1,082 films. This nets an average of $5.11M per film, but three movies accounted for 17% of the $5.53B. I do not have the numbers, but I am assuming that the distribution of revenue is skewed towards a small number of movies, so the $5.11M average is not a great indicator for comparison. The median should be taken into account, which I do not have, but is likely less than the average (assuming the “winners take most” idea). This makes Legend of the Ancient Sword‘s gross look less bad, but it is still, at the very best, an average grossing film for a live action adaption of a gaming IP.

So what went wrong? First off, Alibaba Pictures, which is relatively new as it was branded in 2014, but acquired ChinaVision Media, produced the film. May be one can chalk this up to inexperience. The actors acting “quality” is likely not the issue, as the ensemble cast is diverse (comprising of talent from all over Greater China) and popular (there is without a doubt each of the ensemble cast members are well-known as they are all recognizable industry veterans). The “quality” of the film is comparable to a high-end big-budget fantasy production with special effects, stylish costumes, and suitable sets. Although Alibaba did not disclose the cost to produce the film, it surely lost money as most recent Chinese high fantasy, star studded films of such caliber cost north of $60MM.

Doesn't gaming IP help attract fans of the game? The game GuJian2, which the movie Legend of the Ancient Sword is based on, published in 2013, is an RPG and has a total of 200k – 500k owners (priced at $15.99) with an average of 20 hours and 47 minutes, and a median of 26 hours and 18 minutes of lifetime playtime (per Steamspy). I am unable to compare this game to others in the landscape based on the genre, total owners, total/average playtime, language, player nationality/geography, number of players, but I can definitively say this is not one of the most popular games adapted for the Chinese audience (unlike the popular MMORPG and RTS games the Warcraft film is based on). The top 50 games on Steamspy that have Chinese language support are not owned by Chinese companies (games that do not have sales data are excluded, and just because it has Chinese language support, does not make it the most sought game for Chinese consumers). GuJian content is actually already part of an multimedia ecosystem already, so the box office bomb does come off as quite a surprise. It is very hard to condense a 20+ hour game storyline into a 2 hour movie that would be faithful to and full of the original storyline. The two TV adaption of GuJian did well, likely because a 30-40 episode series can sufficiently cover the source material properly.

It is possible that Chinese companies do not have popular Chinese language and produced games they could use to adapt for movies. The most popular games among hardcore gamers, the ones with competitions and the ones universally known even amount casual gamers, are not owned by Chinese companies with the exception of Tencent (which has their own film division) acquired League of Legends, which is getting its own anime adaption. I am unable to find any data on the overlap between consumers that are hardcore gamers, and moviegoers, but an adapted game with only 500K total users, like GuJian2, is not just focusing on its gamers to come to the theaters. Most game companies do not have a film division, so games can license their IP to studios (or partner with them) with experience, but there does not seem to be activity on that end.

At the end of the day, Legend of the Ancient Sword flopped, and that is likely more attributable to the content and operations (possibly marketing) instead of the popularity (or lack of) of the game. A lot of movies without an embedded fan base (original screenplays) still perform well. It just shows that gaming IP, even with the increase in popularity of gaming, and the increase in demand in movies, does not lead to an easy box office crown or podium spot. Regardless, this one attempt at adapting a Chinese game IP to a live action at the Chinese box office should not cause other studios to disregard game IP, but learn from the lessons.

Animated:

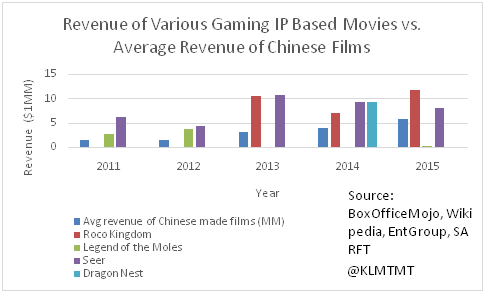

Gaming IP is mainly adapted to animated movies in Mainland China. Let's analyze a few of these and see how they fare. The average revenue of a film in China is likely skewed up because of the strength of a small crop of movies, and the fact the total film category comprises of features, documentaries, educational, specials, made-for-TV movies (the non-feature films usually earn less than feature films) skews the average down. It is impossible to separate the features and non-features since I can barely read Chinese, we can assume that the skew cancels out for the purpose of this article (though I believe the skewing up is greater than the skewing down).

I will discuss a bit about the Chinese video games I know of that were adapted into an animated movie: The Roco Kingdom series, Legend of the Mole series, Seer series, and Dragon Nest: Warriors' Dawn. The Roco Kingdom movie series has certainly done better than the “average” Chinese movie, but they are nowhere near the top 10 in the Chinese box office, please note I am unable to find the revenue of Roco Kingdom 1. The movies grossed between $7.05MM and $11.81MM, which is above the “average” revenue of a Chinese language film for their respective years. The same trend holds true for the Seer series, and Dragon Nest. The Legend of the Moles first two films earned above average, but only the third one in the series (2015) performed to the a miniscule tune of $0.2534MM. Overall animated movies adapted from Chinese gaming IP mostly did better than the average or median revenue of all Chinese films in their respective year.

The numbers do not show gaming IP is taking over the move industry, nor are they doing terribly. It might seem surprising that animated, family-friendly (or “kiddie”) movies with gaming IP, non-super star onscreen and behind the scenes talent performed better than Legend of the Ancient, which has a larger budget, star-studded talent (both behind and in front of the camera), and “high quality” production. What gives?

Animated movies based off of gaming IP likely has its own niche audience, but the format (animation) of telling the story can give gaming IP a familiarity to the actual game and provide a new and exciting language, and context to craft content, that may be more fitting. Legend of the Ancient is more a direct adaption of the video game, while Dragon Nest: Warriors' Dawn is more of a trans-media integration, as the story takes place 50 years before the events in the game. Cross-media integration likely works better and best when the new stories are told in a manner made specifically for the different mediums instead of adhering a story to its original medium and method of storytelling in a different medium. It is also hard to extract too much insight from one underperforming live action movie based on gaming IP, as the sample size is too small.

Isn't gaming IP suppose to cause a virtuous cycle of marginal affinity with every new medium and output? It may be instructive to look at how the video game Dragon Nest is performing as well, as that is the base of the movie. The game is a free-to-play (F2P) MMORPG (so is Roco Kingdom) and had over 200MM players worldwide in 2013 (before the release of the movie) and grossed $180MM (compared to the 500k players for GuJian2) – the in game shop element of the game allows gamers to spend real life currency to purchase equipment and other in-game related attributes and upgrades. The F2P component allowed Dragon Nest to acquire more “customers,” from which it monetized through brand affinity from not just the game, but other media and products. GuJian2 is an upfront one-price game ($15.99) which already limits the customer size. New updates in Dragon Nest allows it to keep gamers constantly involved in the game or they fear missing out on the new change/event. The multiplayer aspect of Dragon Nest versus the single player mode of GuJian2 likely played a big difference in terms of brand affinity, and customer base as once a group of friends begin to play a MMORPG, no one wants to be left out, and consequentially congregate in that game.

Equally important is that Dragon Nest is in not just in other media but products as well. A manga was spun-off from the game. Theme songs were made specifically for Dragon Nest and released through its own self-branded CD, and through various artists' CD (widening the potential fan base). Toys and figurines of characters in Dragon Nest were marketed as well. The expanded ecosystem likely led to above average box office numbers for Dragon Nest through brand affinity and awareness.

Interestingly enough, GuJian2 also had a preceding (GuJian) and succeeding game (GuJian3). GuJian had about the same sales as GuJian2 at $11.99 per game, while GuJian, which came out in December 2018, sold between 500k-1M units at $29.99 per unit. The increase in price point, or price point and units sold between the multiple games, show that brand affinity and awareness was developed at least for the gaming sphere. It is possible that the movie Legend of the Ancient Sword (premiered in October 2018) might have even driven sales of the third entry in the series, which if it did, means the gaming division benefited from and leveraged the movie.

Live action game IP movie adaption will not stop soon. Swords of Legends: Fu Mo Ji (set to air on screens in 2020), part of the Gu Jian universe, is taking another stab at the box office. A film franchise can fail a few times and still be extremely profitable with one hit movie (with ancillary revenue in other media and products not even taken to account). Moreover, the Japanese movie market has been churning out game IP based movies for well over a decade, though this may not be well known outside the Far East. Love O2O, a non-game IP game themed 2016 movie, made close to $40MM in the box office, indicating that gaming as a background or plot device can prove pivotal in the movie industry and prominent in the years to come.

Although live-action Chinese game adaption in the Chinese movie industry is still breaking new levels, there is a lot of content to build on, and promise. Animated game adaption seem to perform relatively well, but have an upper limit on the audience they can attract. It will be interesting to see how many K.O.s (and to what degree) companies are going to take to create a hit.